What Does Frost Pllc Do?

What Does Frost Pllc Do?

Blog Article

Getting The Frost Pllc To Work

Table of ContentsRumored Buzz on Frost Pllc4 Easy Facts About Frost Pllc DescribedThe Frost Pllc IdeasFrost Pllc - The Facts

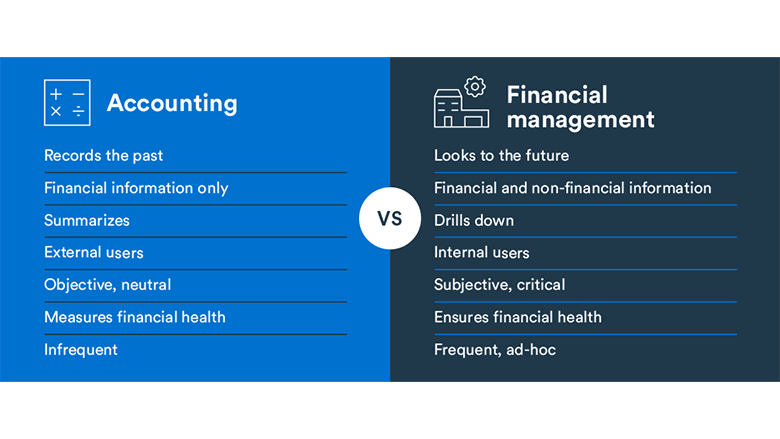

When it involves economic services, there are many different kinds of firms available to pick from. 2 of the most usual are accounting companies and certified public accountant firms. While they might appear similar on the surface, there are some key distinctions in between the 2 that can impact the type of services they offer and the certifications of their staff.Among the vital differences in between accountancy firms and CPA companies is the qualifications needed for their personnel. While both kinds of firms might employ accountants and other financial experts, the second one call for that their personnel hold a certified public accountant permit which is given by the state board of book-keeping and requires passing a strenuous examination, conference education, and experience needs, and adhering to rigorous ethical requirements.

While some may hold a bachelor's degree in audit, others may have just completed some coursework in accountancy or have no formal education in the area in any way. Both accounting firms and CPA firms supply a variety of monetary solutions, such as bookkeeping, tax prep work, and financial planning. There are considerable distinctions in between the services they provide.

These guidelines might include requirements for continuing education and learning, moral standards, and quality assurance treatments. Accounting firms, on the other hand, might not undergo the very same level of regulation. They might still be needed to adhere to specific requirements, such as normally approved accountancy concepts (GAAP) or global economic coverage criteria (IFRS).

Things about Frost Pllc

These services might consist of tax planning, audit solutions, forensic bookkeeping, and critical data-driven evaluation (Frost PLLC). The scope of solutions offered by certified public accountant firms can differ substantially depending upon their size and focus. Some might specialize exclusively in audit and assurance services, while others may provide a larger array of solutions such as tax prep work, business risk monitoring, and consulting

CPA companies may specialize in serving details markets, such as medical care, finance, or genuine estate, and customize their solutions accordingly to satisfy the unique requirements of clients in these sectors. Finally, there are differences in the cost structures of audit firms and certified public accountant firms. Accountancy companies might charge hourly prices for their solutions, or they may provide level costs for particular jobs, such as accounting or economic statement preparation.

Senior Manager and CPA with over two decades of experience in audit and financial services, focusing on danger monitoring and governing compliance. Proficient in taking care of audits and leading groups to supply remarkable services. Pleased papa of 2. Kevin Mitchell LinkedIn Referrals: Orzech, J. (2018, March 14). The Distinction In Between a Certified Public Accountant Company and an Audit Firm.

The Best Guide To Frost Pllc

Lots of bookkeeping company leaders have established that the conventional collaboration model is not the method of the future. At the same time, financier passion in expert solutions companies is at like this an all-time high.

All confirm services are done just by the certified public accountant company and managed by its owners. The CPA firm and the services company become part of a services contract, pursuant to which the services business may offer expert staff, workplace, devices, innovation, and back-office functions such as invoicing and collections. The certified public accountant firm pays the services business a fee for the solutions.

The following are several of the crucial considerations for certified public accountant companies and investors contemplating the formation of an alternate practice framework. Certified public accountant solid possession needs are developed partially to protect attest services and associated judgments from industry stress. That suggests a certified public accountant company giving attest services must continue to be a different lawful entity from the lined up solutions business, with distinctive regulating papers and administration frameworks.

The lower line is that events to an alternative practice framework should meticulously analyze the suitable self-reliance regimens and execute controls to check the CPA firm's self-reliance - Frost PLLC. Many different method structure deals involve the transfer of nonattest interactions and related data. Parties have to think about whether customer permission is called for and suitable notification even when approval is not required

The Main Principles Of Frost Pllc

Frequently, any kind of retirement arrangement existing at the CPA firm is terminated in connection with the transaction, while puts and calls may apply to companion had equity in the solutions business. Associated to the financial considerations, CPA firms need to consider Learn More how the her explanation next generation of company accounting professionals will certainly be awarded as they accomplish ranking that would usually be accompanied by partnership.

Both capitalists and certified public accountant companies will need to stabilize the completing passions of preventing dilution while appropriately incentivizing future firm leaders. Investors and certified public accountant firms require to attend to post-closing governance matters in the solutions business. An investor considering a control financial investment (and connected governance) in the solutions business should consider the increased reach of the auditor self-reliance guidelines in that situation as contrasted to a minority investment.

Report this page